A synthetic long position is a combination of a long call and a short put. Both these options have the same strike price and expiration date. Both these options together mimic the profile of a long future. This means the position have a profit/loss profile equivalent to owning the shares of a stock.

Understanding the Synthetic Long

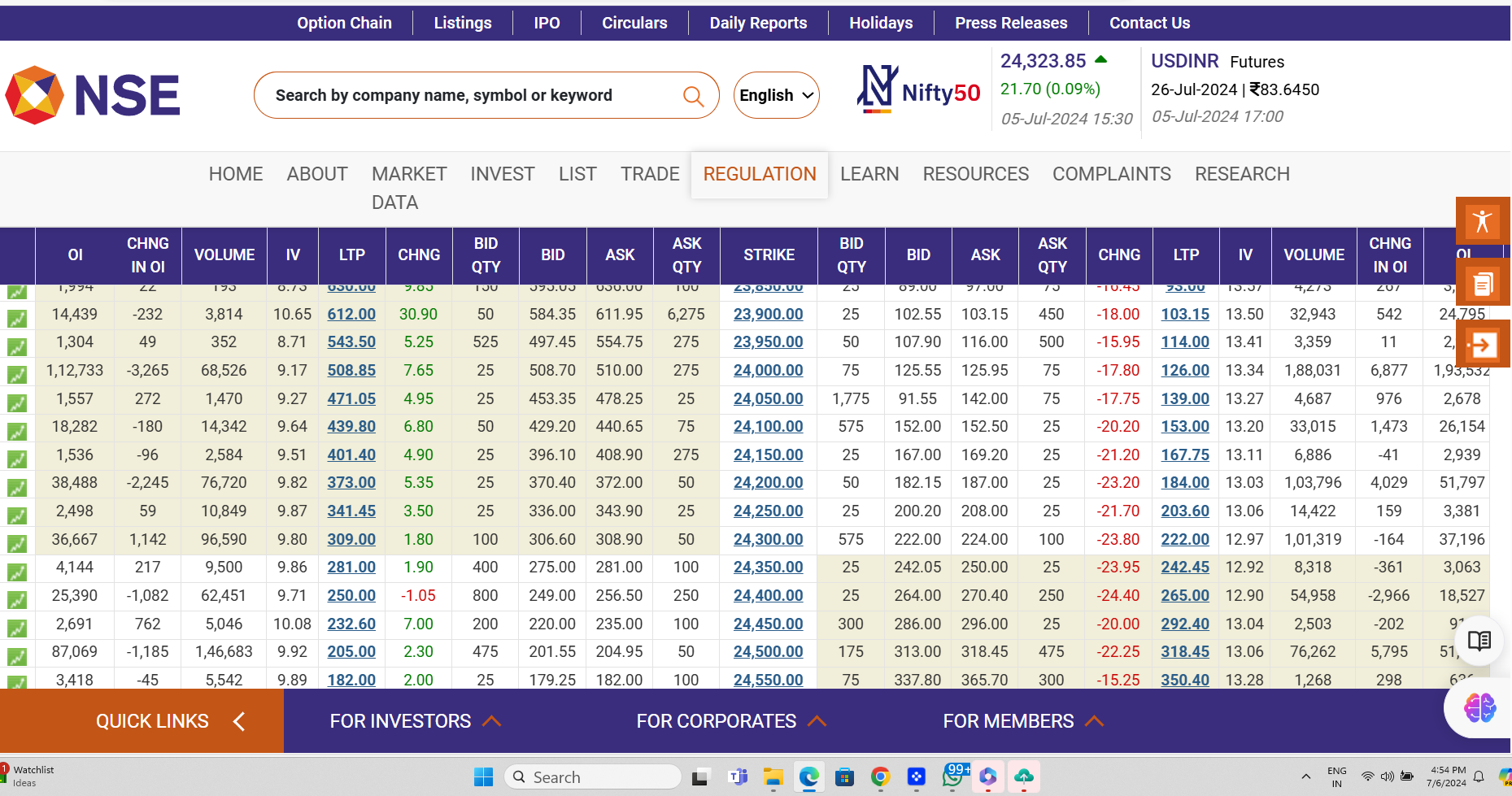

Typically, the strike price is the column in the middle, with call options to the left and put options to the right. Traders will notice that in order for a call and a put to have the same strike price, which is necessary for creating a synthetic long, one of the options will be at-the-money (ATM) or in-the-money (ITM).

When deciding on the strike price for the synthetic long, traders will usually choose the one that is ATM. In the case of a synth long, in this case, 24300 Strike is ATM and 24300 CE premium is Rs.309 24300 PE premium is 222. When you sum up Rs.309 and Rs.222 the answer is Rs.531. This translates that the potential Nifty movement for the current expiry is 531 points, either way, up or down.

The strike price also influences the cost of opening the position. Since buying a call requires paying a premium and selling a put entails collecting a premium–and since the premiums are rarely equally priced–a trader will often open a synthetic long with a debit or credit. Here, in this example, the trader pays Rs.309 towards Call and receives Rs.222 towards Put. The initiation cost for this pair is net debit (Rs.309-Rs.222) is equal to Rs.87. You can also assume that you have a futures contract at Rs.87 per quantity.